There are two kinds of property title documents:

1. Primary title documents

2. Secondary title documents

Primary title documents

These property documents of title are the most essential documents which shows ownership history of the property. It includes unbroken flow of title up to the present owner. This document is also referred as ‘Mula pathra’.

Below are the list of title documents:

Sale deed

A registered sale deed is a legal document that specifies the transfer of title, rights, and ownership of a property from a seller to the buyer. The purchase or sale of the property is legally complete only when the sale deed is signed between the buyer and the seller complying with the terms and conditions in the sale deed. It is also called as conveyance deed.

Gift deed

A registered gift deed is a legal document that allows a property owner to voluntarily transfer title, rights, and ownership to anyone and it avoids any future dispute arising out of succession or inheritance claims.

Partition deed

A registered partition deed is a legal document with which a property can be divided between multiple owners. Once partition deed is executed, each member becomes the independent owner of his/her share in the property and is legally free to sell, rent or gift his asset, according to his/her will.

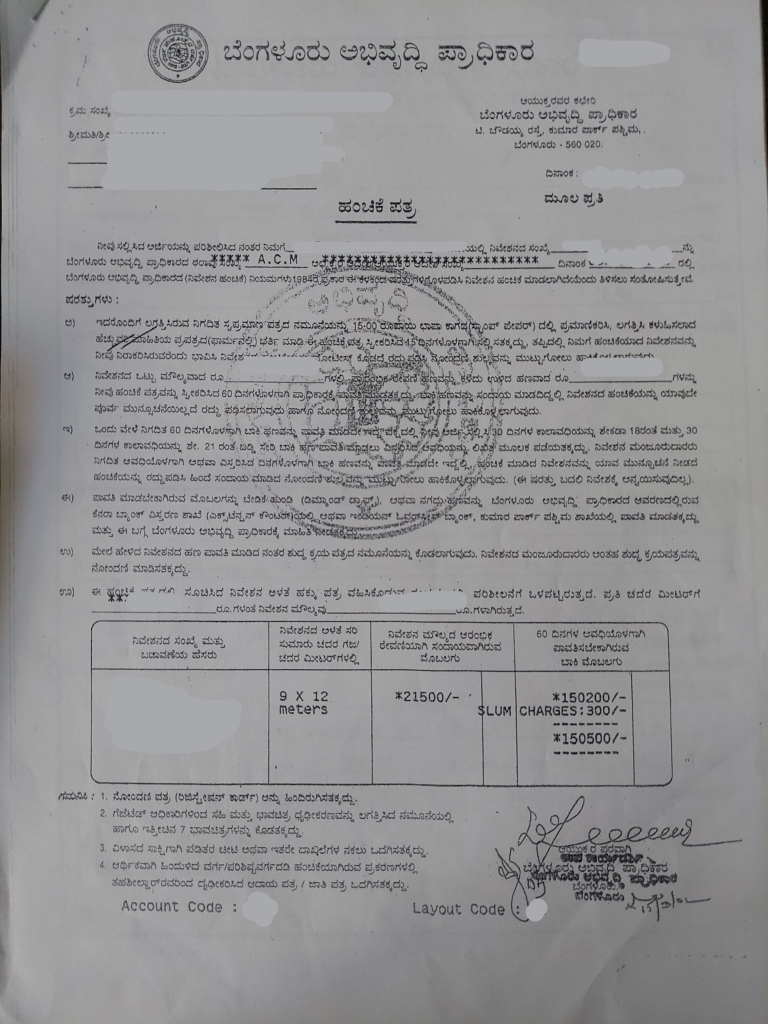

Allotment letter

It is a document that details and confirms the property unit allotted to an applicant in an under-development project.

Below is a sample of Allotment letter (Hanchike patra) issued by BDA.

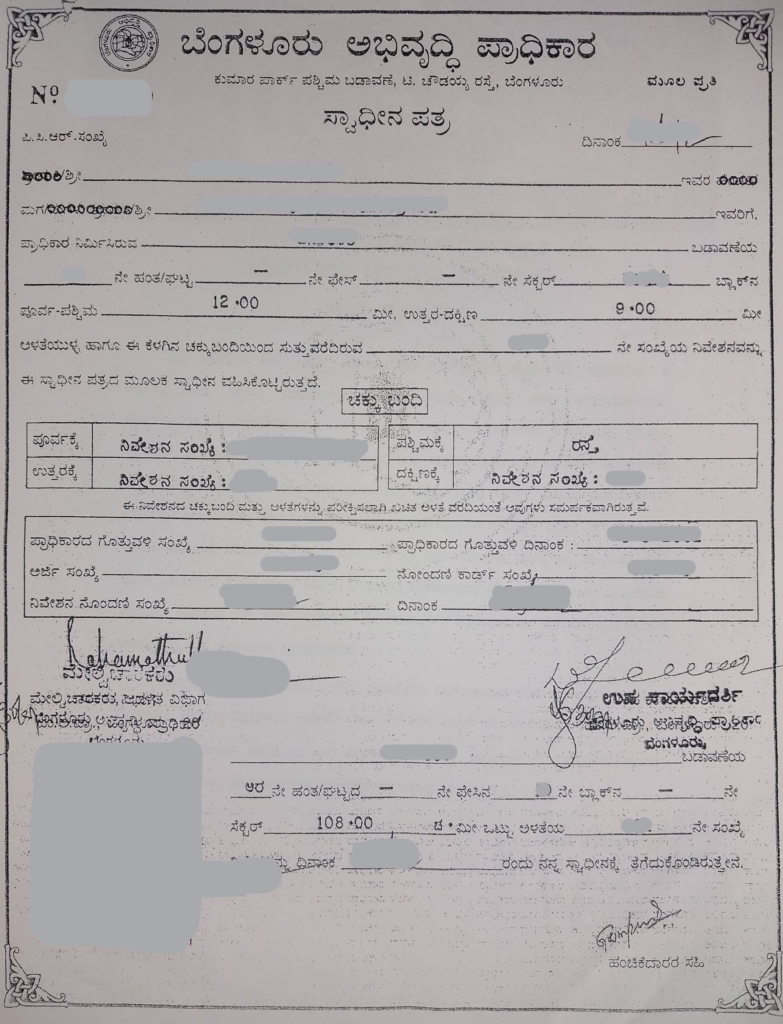

Possession certificate

It is a certificate that details possession of a property to an applicant.

Below is a sample of Possession certificate (Swadina patra) issued by BDA.

Secondary title documents

These property documents of title provide support to the information mentioned in the primary title documents.

Layout plan sanction

Layout plan is approved by BDA or BMRDA (Local planning authorities) for vacant lands under their jurisdiction.

Khata

Khata literally means an ‘account’ that is issued to every person who owns a property by BBMP, BDA or a Village panchayat to collect property tax.

Note: The name on which the Khata is issued alone is not enough to confer any ownership of the property.

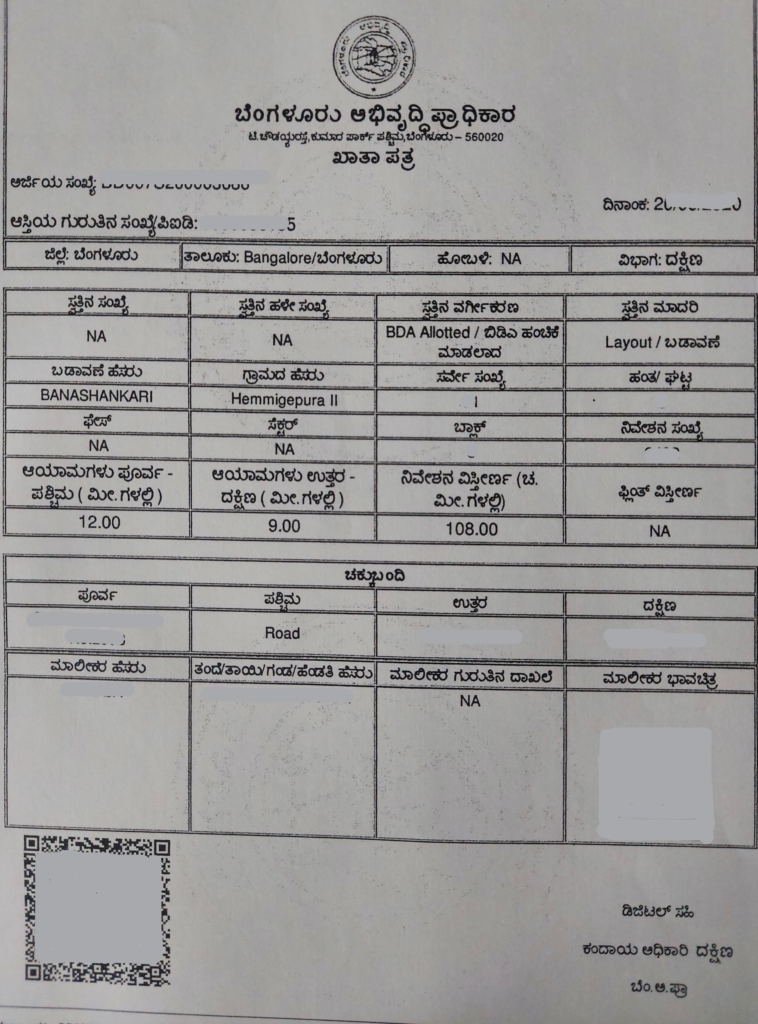

BDA khata

Khata which is issued to BDA allotted and BDA approved properties are called BDA khata.

When BDA handovers a layout to the BBMP after the area becomes a ward, the BBMP issues a new Khata which replaces BDA’s khata, and BDA khata becomes outdated at that time.

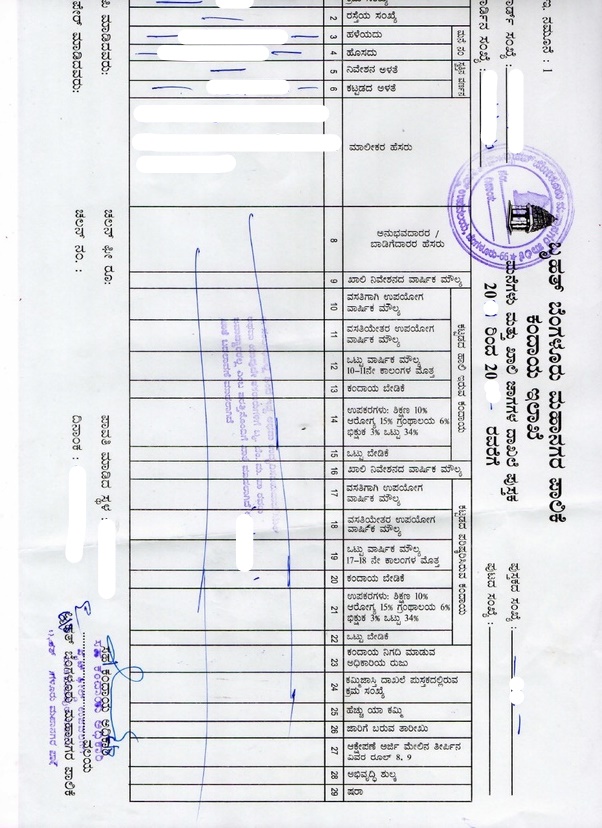

Below is a sample of khata (Khata patra) received online by BDA.

Below is a sample of khata (Khata patra) received offline by BDA.

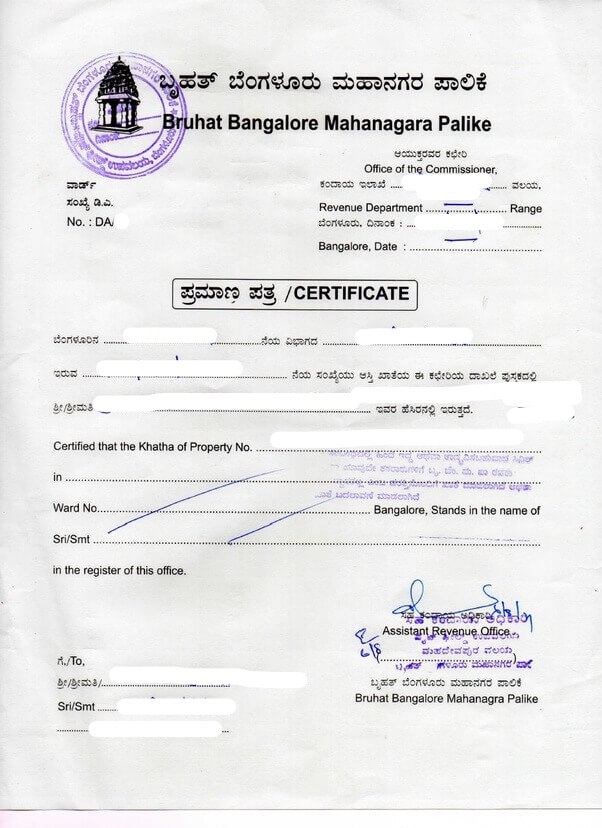

BBMP khata

A Khata which is issued to properties under BBMP limit are called BBMP Khata

BBMP khata has two parts: Khata certificate and Khata extract wich is unofficially together called as “A Khata”

Khata certificate: Khata certificate is required during registration of the property. It is issued for applying water connection, electricity connection, trade license and building license. It is given only to the owner of the property or to his/her legal heirs.

Below is a sample of Khata certificate issued by BBMP.

Khata extract: Khata extract specifies information about the name of the property owner, size of the property, location of the property, built-up area of the property, purpose of utilisation, annual value etc.

Below is a sample of Khata extract issued by BBMP.

BBMP B khata

In order to include properties which are illegal or are in offence of government regulations and building by-laws, a provision was made under Karnataka Municipal Council Act. Under this provision, BBMP collected tax from such properties. The details of the property tax collected are maintained in a separate register called B register and are called B khata.

E khata

Khata that is filed or issued online is known as an E khata or electronic khata, and it allows property holders to pay taxes online.

Encumbrance certificate [EC]

Encumbrance certificate is a record that shows all the registered transactions of a property in a particular period of time. It is issued via “form 15” and “form 16”. If a property is under registered mortgage, sale or any other registered deeds, then “form 15” is issued with details of each transaction in a specified period of time. If there are no registered transactions during a specified period of time, “form 16” is issued.

Below is a sample of EC “Form 15”.

![Encumbrance certificate [EC] Form 15](https://bdasites.in/wp-content/uploads/2022/02/Encumbrance-certificate-EC-Form-15-1024x716.jpg)

Below is a sample of EC “Form 16”.

![Encumbrance certificate [EC] Form 16](https://bdasites.in/wp-content/uploads/2022/02/Encumbrance-certificate-EC-Form-16-1024x756.jpg)

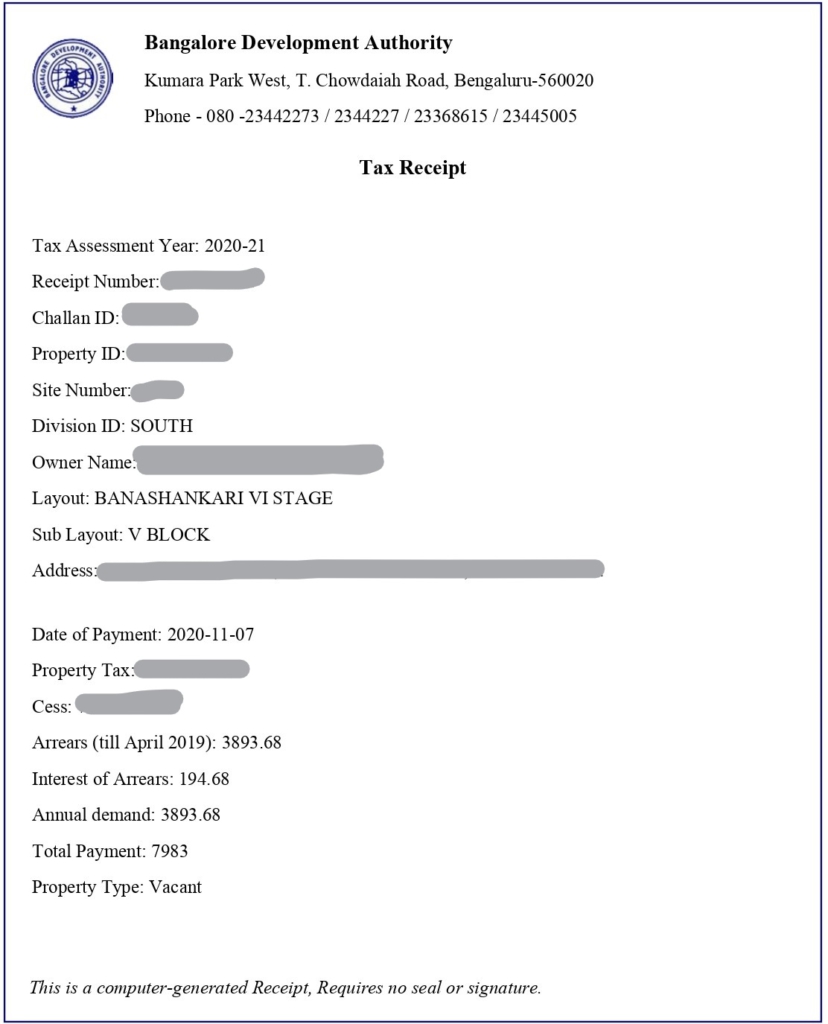

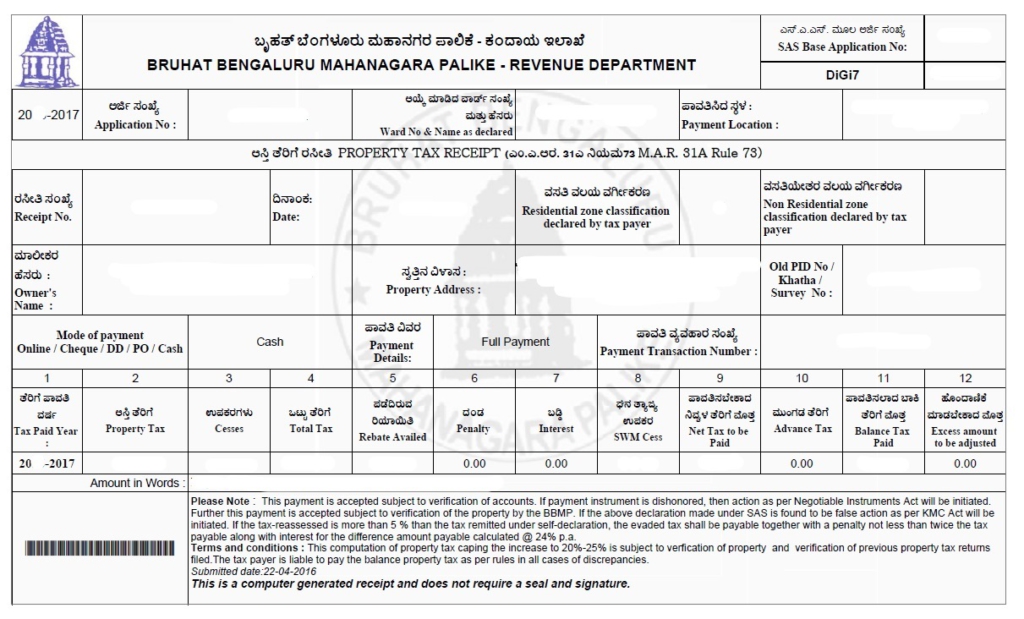

Tax paid receipt

Tax paid receipt is issued by BDA, BBMP or Village panchayat against payment of property tax.

Below is a sample of tax paid receipt issued by BDA.

Below is a sample of tax paid receipt issued by BBMP.

Note: The name on which the tax paid receipt is issued alone is not enough to confer any ownership of the property.

Family tree

Family tree is a document which helps in knowing the present and past owners of the property being sold. It shows genealogical order of a family in the form of flow chart, indicating the names and age of the family members and it also indicates whether the family members are living or dead.